I've been around cotton long enough to know that the real battle isn't just in the fields—it's in keeping the money moving without it drying up on you. After a decade or more at this, you probably don't need me telling you about basic budgeting. But let's talk real strategies that go beyond the obvious, the kind that help you sleep better when inputs skyrocket or prices dip. I've pulled from what works on the ground, focusing on smoothing out those peaks and valleys in your operation.

First off, let's get one thing straight: cash flow isn't about chasing the highest yield or the perfect market timing every season. It's about structuring your operation so you're not scrambling when the gin check is late or equipment breaks down. Think of it as building a buffer that lets you focus on farming, not financing.

Start with a Rock-Solid Cash Flow Projection

You know the drill—planting season hits, and suddenly you're writing checks left and right. But for seasoned folks like us, a detailed projection isn't just a spreadsheet; it's a roadmap. Map out your inflows (crop sales, any side revenue) against outflows (seeds, fuel, labor) month by month. Factor in the cotton cycle: heavy outflows early, inflows concentrated around harvest.

Here's a simple table to illustrate a basic monthly cash flow outline for a mid-sized cotton operation. Adjust the numbers to your scale, but the idea is to spot gaps early.

| Month | Expected Inflows ($$ ) | Expected Outflows ( $$) | Net Cash Flow ($$ ) | Cumulative Balance ( $$) |

|---|---|---|---|---|

| January | 5,000 (misc sales) | 20,000 (equipment maintenance) | -15,000 | -15,000 |

| February | 0 | 50,000 (seeds/fertilizer) | -50,000 | -65,000 |

| March | 10,000 (government payments) | 30,000 (planting prep) | -20,000 | -85,000 |

| April | 0 | 40,000 (labor/fuel) | -40,000 | -125,000 |

| May | 0 | 25,000 (irrigation) | -25,000 | -150,000 |

| June | 0 | 15,000 (pest control) | -15,000 | -165,000 |

| July | 0 | 10,000 (misc) | -10,000 | -175,000 |

| August | 0 | 20,000 (harvest prep) | -20,000 | -195,000 |

| September | 100,000 (early sales) | 50,000 (harvest costs) | 50,000 | -145,000 |

| October | 200,000 (main harvest) | 30,000 (ginning/transport) | 170,000 | 25,000 |

| November | 150,000 (remaining sales) | 10,000 (wrap-up) | 140,000 | 165,000 |

| December | 50,000 (final payments) | 15,000 (year-end taxes) | 35,000 | 200,000 |

This isn't fancy, but running scenarios—like what if prices drop 10% or rain delays harvest—can show you where to cut or borrow short-term. Tools like farm management software make this easier, but even Excel does the trick if you're old-school.

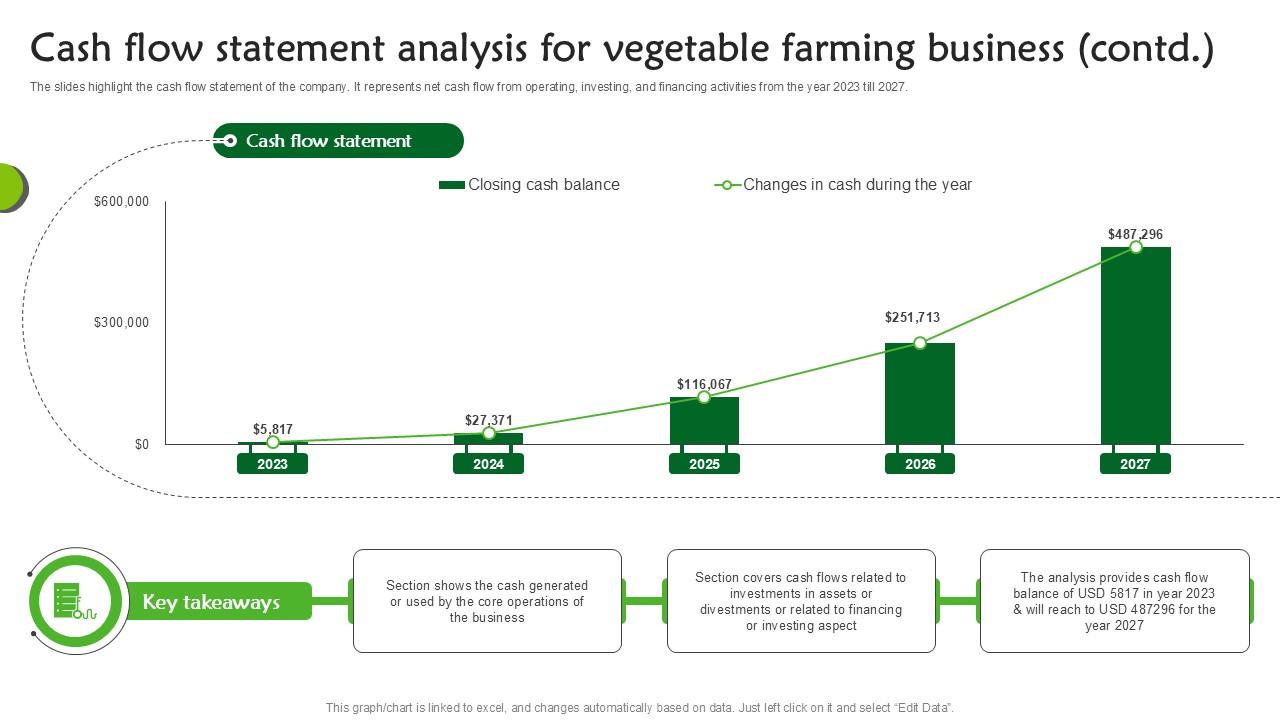

Cash Flow Statement Analysis For Vegetable Farming Vegetable ...

Trim Costs Without Cutting Corners

We've all been there: input prices climb, and margins shrink. The key for experienced growers is targeted cuts that don't compromise yield. Skip the blanket reductions; focus on efficiency.

- Negotiate inputs early. Lock in fertilizer or chemicals with suppliers for volume discounts. If you're running 500+ acres, bundle purchases across seasons to build leverage.

- Lease over buy for big-ticket items. Why tie up capital in a new picker when leasing spreads payments and keeps cash liquid? Factor in tax benefits—depreciation on owned gear is nice, but liquidity wins when cash is tight.

- Optimize labor and fuel. Use precision ag to cut unnecessary passes. Drones or soil sensors aren't gimmicks; they save real dollars on water and inputs. One grower I know shaved 15% off fuel by mapping fields better.

Reducing costs by even 5-10% can free up thousands, but track it religiously. If you're not reviewing expenses quarterly, you're leaving money on the table.

Marketing Moves to Steady the Flow

Cotton prices swing like a pendulum, and waiting for harvest to cash in is a gamble. Diversify your sales to avoid all-or-nothing.

- Forward contracting with flexibility. Fix portions early if basis looks good, but use options like on-call contracts to capture upside. Don't lock everything—leave room for market rallies.

- Government loans as a bridge. Put bales under CCC loan for immediate cash without selling low. It's low-interest breathing room while you wait for better prices.

- Sell and repurchase. If you need cash now, sell spot and buy calls to hedge. It's not foolproof, but it beats borrowing at high rates.

The goal? Spread inflows so you're not feast-or-famine. In my experience, aiming for 30-50% priced pre-harvest keeps banks happy and stress low.

Diversify Revenue Streams

Relying solely on lint and seed is risky. Branch out without overhauling your setup.

- Add cover crops or rotations. If soil allows, plant legumes between seasons for extra income or subsidies. It improves land long-term too.

- Side ventures. Lease idle land for hunting, or process gin trash into mulch. One operation turned to custom ginning for neighbors—steady cash outside your cycle.

- Off-farm income. Not glamorous, but rental properties or dividend stocks buffer against bad years. It's about making cotton a piece, not the whole pie.

Diversification isn't a quick fix, but over time, it turns volatility into stability.

In the end, strong cash flow is what lets you farm another day. It's not about getting rich quick; it's about endurance. Tinker with these ideas, run your numbers, and adjust. You've got the experience—now put it to work keeping the operation humming. If something here sparks a tweak in your setup, that's the win.